来源:小编 更新:2024-12-21 12:50:13

用手机看

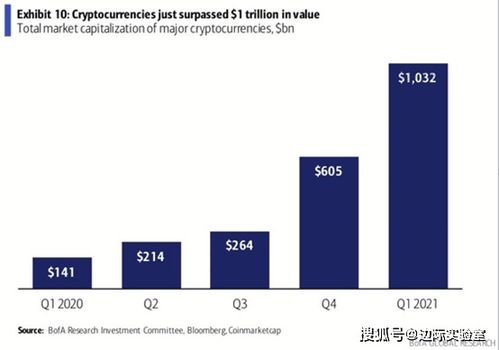

As we delve into the world of cryptocurrencies, it's essential to stay updated with the latest trends and developments. In today's Daily财经英语 update, we'll explore the significance of blockchain technology, the rise of decentralized finance (DeFi), and the regulatory landscape in key markets. Let's dive in!

Blockchain technology, the backbone of cryptocurrencies, has revolutionized the way we perceive and interact with digital transactions. Unlike traditional centralized systems, blockchain operates on a decentralized network, ensuring transparency, security, and immutability. This technology has paved the way for various applications beyond cryptocurrencies, such as smart contracts and decentralized applications (DApps).

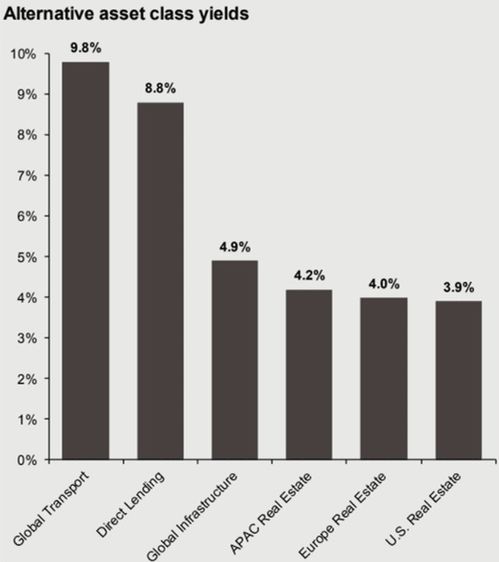

Decentralized Finance, or DeFi, is a rapidly growing sector within the cryptocurrency ecosystem. It aims to recreate traditional financial services, such as lending, borrowing, and trading, on a decentralized platform. DeFi leverages blockchain technology to eliminate intermediaries, reduce costs, and provide users with greater control over their finances. As DeFi continues to gain traction, we can expect to see more innovative financial products and services emerge.

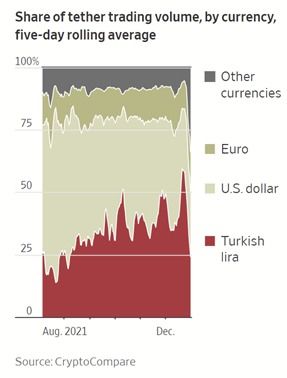

The regulatory landscape surrounding cryptocurrencies remains a topic of debate and concern. Governments and regulatory bodies worldwide are grappling with how to regulate this emerging asset class while ensuring consumer protection and market stability. In some countries, such as Malaysia, the regulatory environment is relatively friendly, with a focus on fostering innovation while protecting investors. However, in other regions, the regulatory stance is more cautious, with strict regulations and restrictions in place.

Two of the most prominent cryptocurrencies, Bitcoin and Ethereum, continue to dominate the market. Bitcoin, often referred to as